How Measure C Works

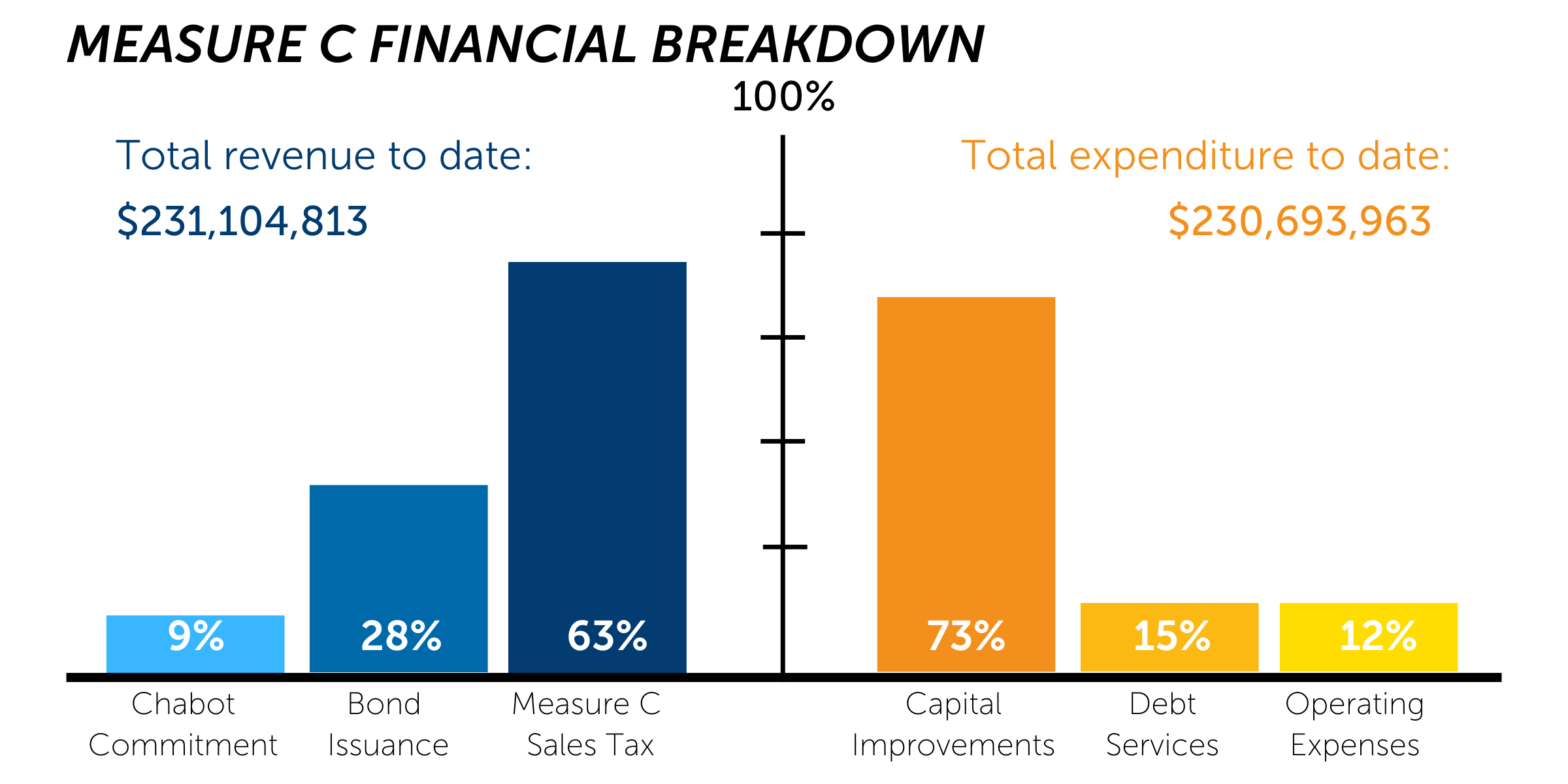

The Measure C half-cent sales tax currently generates about $20 million a year, revenue which, importantly, is legally dedicated for municipal purposes and cannot be taken or diverted away by county or state government for other uses. Each year, the City Council programs Measure C dollars as part of the annual budget process. The money is used in three ways—to repay borrowing for facility construction (called debt service), to fund capital improvements, such as street projects, and pay operating expenses associated with increased staffing at the Hayward Police and Maintenance Services Departments.

June 27, 2023 - City Council Meeting

Community Survey Results: Receive Presentation of Community Survey Results and Consider Potential Ballot Measure for Future Facilities Needs

April 11, 2023 - City Council Meeting

Adopt a Resolution Authorizing the City Manager to Appropriate $640,894 from the Measure C Operating Fund (Fund 101) for the Purchase of Motorola Dispatch Console Equipment and Service Plans and to Execute an Agreement with Motorola for Purchase of those Products

April 11, 2023 - City Council Meeting

Adopt a Resolution Authorizing the City Manager to Appropriate $88,598.89 from the Measure C Operating Fund (Fund 101) for the Purchase of (1) EagleAir(r) Model RVA15M3D4U RavenCFS Breathing Air Compressor System

June 15, 2022 - Council Budget & Finance Committee Meeting

Measure C Debt Analysis and Review

- Staff Report

- Measure C Ballot Language

- Staff Report - March 04, 2014

- Measure C 20-Year Financial Forecast Update

December 07, 2021 - City Council Meeting

Measure C Annual Report: Review Annual Report of Measure C Revenues and Expenditures, Approved by Voters on June 3, 2014 (Report from Finance Director Claussen)

November 17, 2021 - Council Budget & Finance Committee Meeting

Measure C Annual Report: Review Annual Report of Measure C Revenues and Expenditures, Approved by Voters on June 3, 2014

January 26, 2021 - City Council Meeting

Measure C Annual Report: Review Annual Report of Measure C, Approved by Voters on June 3, 2014, Revenues and Expenditures (Report from Finance Director Claussen)

November 19, 2019 - City Council Meeting

Measure C (2014 City's Sales and Use Tax) Annual Report

October 02, 2019 - Council Budget & Finance Committee Meeting

Measure C Annual Report

January 08, 2019 - City Council Meeting

Approval to Appropriate Funds from the Measure C Operating Fund for the 2016 Lease-Purchase of 532 Radios for Police and Field Personnel, Not to Exceed $2,600,000

October 02, 2018 - City Council Meeting

Measure C Annual Report

June 20, 2018 - Council Budget & Finance Committee

Measure C Annual Report

November 14, 2017 - City Council Meeting

Measure C Sales Tax Initiative - Annual Report

July 19, 2017 - Council Budget & Finance Committee

Measure C Annual Report

July 06, 2016 - Council Budget & Finance Committee Meeting

Measure C (District Sales Tax) Annual Report FY 2016

July 14, 2015 - City Council Meeting

Financing Plan for Measure C—Funded Capital Projects

December 16, 2014 - City Council Meeting

Measure C Implementation and Funding Plans

July 08, 2014 - City Council Meeting

Resolution Acknowledging Receipt of Canvass of the General Municipal Election Held June 03, 2014, and Declaring the Results Thereof: #7 At said election Measure C, a ballot measure relating to Use (Sales) Tax, was voted on and aaproved by the electorate.

View More Legislative Items: